VAT in EU exports

Normally, when a company exports, it does not includes VAT in its pricing and invoices. Still, there are some cases when companies trading on our platform have to add VAT in their invoices and prices.

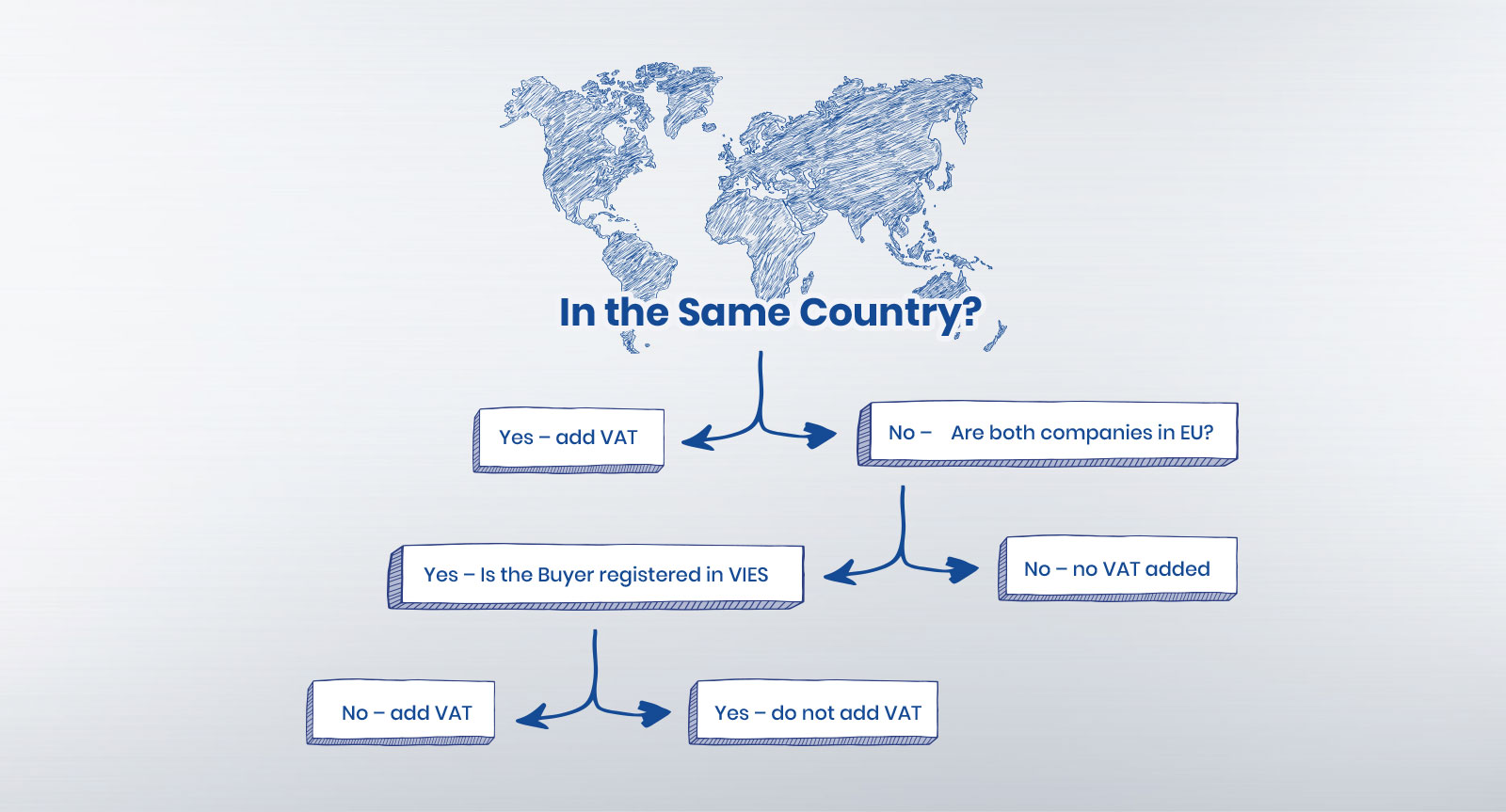

The first case is when the buyer and the seller are based in the same country. That they established contact through our marketplace, does not mean they should treat the trading as export or import.

The second case is when the buyer and the seller are based in different countries from the European Union. The criteria here is if the buyer is registered in the VIES database for intra-community trade. If the buyers is not registered, and the seller is from another EU country, the price should include VAT. The VAT rate the seller has to apply is the rate applicable in its country.

In order to facilitate the trading process, we included software that checks if a company is registered in the VIES system. When a seller receives a request from a buyer for the sale of some goods, the seller can check the buyer’s profile to see if the company is registered in VIES. Do not worry if the company is not registered in the VIES system. It does not mean that its tax number is wrong or there is some kind of problem. Different countries apply different rules with regard to registering their companies in the VIES system.

If your company is registered in the VIES system, but it is not reflected in the badge next to the name of your company, please contact us. As a buyer, if the seller does not apply VAT in its invoice, and you buy and receive goods for business purposes from another EU country, you must account for the VAT on the transaction as if you had sold the goods yourself, at the applicable rate in your country. Normally, you will later be able to deduct this amount.

There are several important exceptions to these basic rules. We would strongly recommend that you visit the EU page for obtaining more information on these exceptions.

As for countries outside the EU, if you sell goods to customers outside the EU, you do not charge VAT, though you may still deduct the VAT you yourself have paid on your related expenses (goods/services bought in specifically to make those sales).

If you buy goods for the purposes of your business from a supplier based outside the EU, you must generally pay VAT at the point of import (and may deduct this in your next VAT return if you make taxed sales).